DocSend 2023 Year-End Data Indicates Positive Fundraising Momentum Going Into 2024

Pitch Deck Interest metrics post gains in investor engagement after six quarters of consistent decline

SAN FRANCISCO, Jan. 17, 2024 /PRNewswire/ -- DocSend, a secure document sharing platform and Dropbox (NASDAQ: DBX) company, released a new data analysis of startup fundraising showing positive momentum for the first time in six quarters, based on investor engagement with pitch decks. The Pitch Deck Interest (PDI) metrics prompt hope for increased dealmaking in Q1, due to encouraging year-over-year (YoY) investor interest and founder activity.

2023: Investors take action in Q4 despite market uncertainty

Investor activity increased 1.7% quarter-over-quarter (QoQ), signaling encouraging progress into 2024. Investors reviewed more pitch decks as uncertainty and economic concern subsided and eagerness to invest in disruptive industries, like Artificial Intelligence (AI), grew. Conversely, founders were less active in sending out their pitch decks to investors in Q4, with activity dropping almost 6% QoQ.

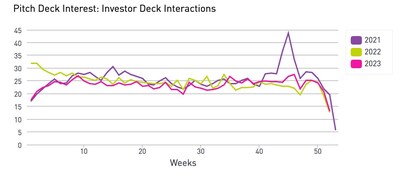

The YoY analysis shows a different, busier picture of Q4 for both investors and founders, as activity levels rose above 2022 for the first time. Pitch deck interactions and founder links created increased 6.7% and 4.2%, respectively. Investor time spent reviewing decks continuously decreased over 2023, hitting an all-time low in Q4 of two minutes and 24 seconds. As investors' attention spans become scarce, founders are forced to streamline and condense their pitch decks to compete for seconds of mindshare.

"As we enter 2024, we are seeing glimmers of hope for founders seeking funding," said Justin Izzo, lead data and trends analyst at Dropbox DocSend. "The small increase in QoQ investor activity signals that investors may be more engaged during the post-holiday January rush, finally at ease after a series of jarring interest rate hikes and increased inflation. The shock of these macro trends is wearing off and there is hope that a more consistent and predictable early-stage fundraising market lies ahead."

Year-to-date (YTD) data shows VC activity lagged in Q1 and Q2 of 2023, although the discrepancy includes efforts from 2021's strong finish that carried over into early 2022. This is reflected in YTD metrics with investor pitch deck interactions dropping by 4.8% and investor time spent dropping by 3.8%, all while founder links created jumped 2%.

New year, new venture capital landscape

Deal activity was down in 2023 as 38% of VCs disappeared from dealmaking in the first three quarters, according to Pitchbook. But Q4's 6.7% jump in investor engagement, per DocSend data, shows investors are increasingly interested in new opportunities to allocate capital, signaling a potential increase in dealmaking in early 2024.

"Investors hesitated to make deals in 2023 due to a series of macroeconomic factors, but our data provides a glimpse into future investment flows by looking at current deal interest," said Izzo. "After the last 15-18 months of considerable stress on the market, venture capital seems to be approaching a period of increased confidence. Q4 has shown investor re-engagement, and VCs are potentially ready to make up for the deals they opted out of earlier in the year."

Key Leading Indicators of Fundraising Activity

There are three core metrics unique to DocSend for tracking investors' hunger for deals and founders' quest for capital.

- Founder links created - the average number of pitch deck links each founder is creating via DocSend. This serves as a proxy for the supply of startups seeking funding. A "link" refers to the unique URL a founder creates using DocSend to share their pitch deck with investors. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor deck interactions - the average number of investor interactions for each pitch deck link. This serves as a proxy for demand for investments. The higher the interaction metric, the more often decks are viewed, shared, and revisited by potential investors.

- Investor time spent - the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 30,000 customers of all sizes use DocSend today. Learn more at docsend.com.

About Dropbox

Dropbox is one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in San Francisco, CA. For more information on our mission and products, visit dropbox.com.

Media Contact:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2023-year-end-data-indicates-positive-fundraising-momentum-going-into-2024-302036345.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2023-year-end-data-indicates-positive-fundraising-momentum-going-into-2024-302036345.html

SOURCE DocSend