Magellan Midstream Files Investor Presentation Highlighting Benefits of Pending ONEOK Transaction

Transaction delivers full value to Magellan unitholders and provides unitholders with ownership in a stronger combined company

Combined company better positioned to address secular risks and achieve strong growth and value creation over the long term

Board carefully considered alternative opportunities, structures and tax implications

Magellan urges unitholders to vote "FOR" the pending merger today

TULSA, Okla., Aug. 29, 2023 /PRNewswire/ -- Magellan Midstream Partners, L.P. (NYSE: MMP) ("Magellan") today announced the filing of an investor presentation with the U.S. Securities and Exchange Commission in connection with our pending merger with ONEOK, Inc. (NYSE: OKE) ("ONEOK"). The investor presentation is also available at MaximizingValueforMMPunitholders.com.

"We are confident the pending merger with ONEOK is the best path forward for Magellan and is in the best interests of Magellan unitholders," said Aaron Milford, chief executive officer. "The merger provides significant premium value to Magellan unitholders, with a meaningful upfront cash consideration as well as substantial ownership in a stronger combined company that has greater growth opportunities, scale, diversification and resilience. We urge all Magellan unitholders to vote 'FOR' the pending merger today to receive full value for their units."

Highlights of the presentation include:

Magellan believes the transaction delivers full value to Magellan unitholders

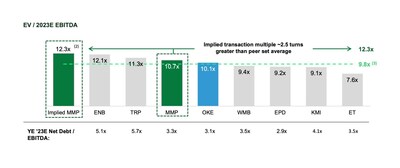

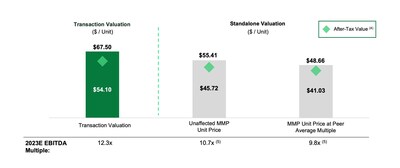

- Transaction multiple and premium exceed precedent industry transactions, representing the highest enterprise value to adjusted EBITDA ("EV / EBITDA") multiple of comparable midstream energy transactions since 2016, an EV / EBITDA multiple that is 2.5x higher than Magellan's publicly traded peers1, and, at 22%, the highest premium of comparable midstream transactions since the pandemic induced a sector re-rating

- Implied value of merger consideration exceeds Magellan's trading value at any point in approximately 5 years

- Board negotiated 4 price increases, fiduciary out, lower termination fee, ability to pay pre-closing special distributions and significant cash component – and carefully evaluated ONEOK assets, strategy and track record before determining transaction maximized value

- As shown below, the proposed transaction premium adds to Magellan's already premium EV / EBITDA trading multiple. If the transaction fails to close, Magellan's unit price could decline to a multiple in line with our peers, which would result in a 28% decline to the implied transaction value

Exhibit 1: Transaction premium adds to an already premium trading multiple1

Exhibit 2: Potential risk of multiple re-rating if transaction does not close1

Magellan could face long-term secular risks as a standalone company; Magellan believes that the valuation offered in the merger captures fair value for unitholders and that the transaction mitigates these risks, creating a diversified, scaled and resilient combined company that is well-positioned for the long term

- Many respected third parties forecast demand for U.S. refined products to decline more than 40% from 2022 to 2050; if correct, these forecasts represent lower demand than we currently expect and than is represented in the value received in the merger

- Crude oil production to remain below existing pipeline capacity, placing downward pressure on utilization and re-contracted rates

- There are more limited attractive growth opportunities in crude oil and refined products segments

- Significant sector consolidation leaves fewer viable M&A and other strategic opportunities

- Implementing inorganic growth opportunities would likely result in paying (rather than receiving) transaction premiums and issuing equity that we believe has been consistently undervalued absent this merger

- With enhanced scale and diversification, the combined company will have greater growth opportunities and be better positioned across industry cycles

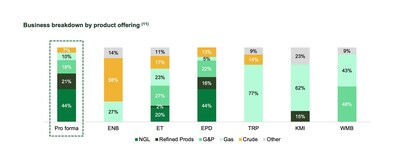

- Combined company to have resilient product mix, mirroring that of larger-scale peers

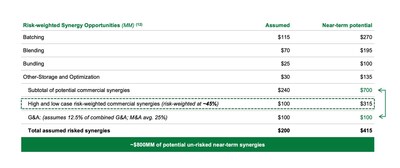

- Potential uplift of approximately $6.1 billion (approximately $7 per Magellan unit pro-rata6) from capitalized risked synergies and significant tax deferral

- Global demand for natural gas and NGL-related products is expected to increase more than 20% through 20407

- Adds more than $1.5 billion of diversified annual EBITDA, more than 85% of which is fee-based, reducing commodity exposure and cash flow volatility

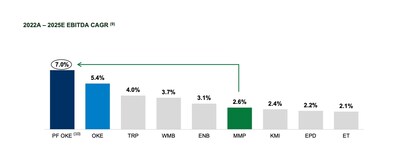

- Increases EBITDA CAGR by approximately 170% through 2025, with pro forma growth expected to outpace midstream peers8

- 4.0x step-up in free cash flow after distributions to approximately $1 billion average annually (2024 to 2027), enabling increased spending on value-creating organic growth projects

- Strong pro forma balance sheet creates financial flexibility to increase capital deployment at attractive returns, while also returning capital to shareholders through substantial dividends and share repurchases

- Increased scale provides more trading liquidity, a broader investor base and inclusion in the S&P 500 index

Exhibit 3: Combined company has stronger growth outlook than standalone MMP

Exhibit 4: MMP unitholders will gain exposure to a resilient asset profile, with higher growth than standalone MMP

Exhibit 5: Risk-weighted synergy opportunities

Magellan board carefully reviewed alternative opportunities, structures and tax implications

- Transaction offers greater net proceeds than an open-market sale prior to announcement would have and greater certainty than holding out for a higher open-market price in the future

- Merger is likely superior to a future Magellan sale when considered in present value terms: future after-tax proceeds are not likely to be as high and a comparable market premium may not be available

- Transaction is also superior to converting Magellan to a C-Corp. as a standalone strategy due to the merger's known premium and inclusion in S&P 500, versus the uncertain results of a C-corp. conversion

- One investor has publicly opposed the transaction, but its analysis is flawed:

- Misconstrues the true current tax situation by assuming all longer-tenured unitholders never sell

- Ignores prospective market value and related upside of stronger combined company

- Focuses mainly on a near-term dividend model with no terminal value and ignores the high present value of the after-tax cash consideration offered

- Determines after-tax value for Magellan standalone of just $29.50 per unit, based on its long-term dividend discount model–less than 55% of the after-tax merger consideration

- The same investor has misrepresented the tax implications of the transaction:

- The merger does not create any new tax liability (beyond that associated with the premium) – the return on MLP units is tax-deferred, not tax-free

- This analysis generally ignores the existing tax liability of Magellan unitholders or alternatively references the amount today as relevant in the future when in fact this liability will continue to grow (estimated to more than double to approximately $20 per unit on average by 2027)

- The transaction premium, like any premium, increases a unitholder's overall tax liability to reflect a higher gain than the unitholder would have incurred absent the transaction, but also delivers a greater after-tax return than an open-market sale

- Comparing after-tax merger proceeds with pre-tax trading prices is misleading – any monetization triggers a taxable event and more than 60% of Magellan unitholders typically sell within five years

- Comparing the higher after-tax proceeds of the merger to the lower after-tax proceeds of an open-market sale prior to the merger being announced is a more meaningful analysis than comparing premium received to taxes owed

The special meeting of unitholders will be held virtually on Sept. 21, 2023 at 10:00 a.m. Central Time. Magellan unitholders of record at the close of business on July 24, 2023 are entitled to vote at, or submit proxies in advance of, the special meeting. The Magellan board of directors unanimously recommends that Magellan unitholders vote "FOR" the proposals related to Magellan's merger with ONEOK.

Magellan unitholders who need assistance in completing the proxy card, need additional copies of the | |

Morrow Sodali, LLC | MacKenzie Partners, Inc. |

Phone: (800) 662-5200 or (203) 658-9400 | Phone: (800) 322-2885 or (212) 929-5500 |

Email: MMP@info.morrowsodali.com | Email: proxy@mackenziepartners.com |

About Magellan Midstream Partners, L.P.

Magellan Midstream Partners, L.P. (NYSE: MMP) is a publicly traded partnership that primarily transports, stores and distributes refined petroleum products and crude oil. Magellan owns the longest refined petroleum products pipeline system in the country, with access to nearly 50% of the nation's refining capacity, and can store more than 100 million barrels of petroleum products such as gasoline, diesel fuel and crude oil. More information is available at www.magellanlp.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that ONEOK or Magellan expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as "estimate," "project," "predict," "believe," "expect," "anticipate," "potential," "create," "intend," "could," "would," "may," "plan," "will," "guidance," "look," "goal," "future," "build," "focus," "continue," "strive," "allow" or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan (the "Proposed Transaction"), the expected closing of the Proposed Transaction and the timing thereof and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend payments and potential share repurchases, increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the Proposed Transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the risk that ONEOK's and Magellan's businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the Proposed Transaction or that unitholders of Magellan may not approve the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied, that either party may terminate the merger agreement or that the closing of the Proposed Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Proposed Transaction; the occurrence of any other event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction; the risk that changes in ONEOK's capital structure and governance could have adverse effects on the market value of its securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on ONEOK's and Magellan's operating results and business generally; the risk the Proposed Transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk of any litigation relating to the Proposed Transaction; the risk that ONEOK may be unable to reduce expenses or access financing or liquidity; the impact of a pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond ONEOK's or Magellan's control, including those detailed in the joint proxy statement/prospectus (as defined below). All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward looking statement speaks only as of the date on which such statement is made, and neither ONEOK nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

NON-GAAP FINANCIAL MEASURES

This communication includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Magellan and ONEOK are unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included, and no reconciliation of the forward-looking non-GAAP financial measures is included.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Proposed Transaction, on July 25, 2023, ONEOK and Magellan each filed with the Securities and Exchange Commission (the "SEC") a definitive joint proxy statement/prospectus (the "joint proxy statement/prospectus"), and each party has and will file other documents regarding the Proposed Transaction with the SEC. Each of ONEOK and Magellan commenced mailing copies of the joint proxy statement/prospectus to shareholders of ONEOK and unitholders of Magellan, respectively, on or about July 25, 2023. This communication is not a substitute for the joint proxy statement/prospectus or for any other document that ONEOK or Magellan has filed or may file in the future with the SEC in connection with the Proposed Transaction. INVESTORS AND SECURITY HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO, AND OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors can obtain free copies of the joint proxy statement/prospectus and other relevant documents filed by ONEOK and Magellan with the SEC through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy statement/prospectus, are available free of charge from ONEOK's website at www.oneok.com under the "Investors" tab. Copies of documents filed with the SEC by Magellan, including the joint proxy statement/prospectus, are available free of charge from Magellan's website at www.magellanlp.com under the "Investors" tab.

NO ADVICE

This communication has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Magellan unitholders should consult their own tax and other advisors before making any decisions regarding the Proposed Transaction.

- Analysis based on market data and street consensus estimates as of May 12, 2023 (last trading day prior to transaction announcement). Peer group includes ENB, TRP, WMB, EPD, KMI and ET

- Represents EV / 2023E EBITDA multiple implied by transaction

- Reflects average EV / EBITDA multiple of ENB, TRP, WMB, EPD, KMI and ET

- Weighted average after-tax value

- Analysis based on market data and street consensus estimates as of May 12, 2023 (last trading day prior to transaction announcement)

- Total potential uplift of approximately $6.1 billion (calculated as $415 million annual pre-tax synergies (the upper end of estimated risked synergies) capitalized at 11x plus $1.5 billion present value of tax deferrals) multiplied by Magellan's approximately 23% pro forma ownership in the combined company divided by Magellan's fully diluted units outstanding at time of transaction announcement

- Source: EIA and Wood Mackenzie

- EBITDA CAGR for MMP and OKE based on financial projections as disclosed in the definitive joint proxy statement / prospectus filed with the SEC on July 25, 2023 (the "joint proxy statement / prospectus"), including $415 million of run-rate synergies (high case for risk-weighted synergies); peer EBITDA forecast reflects street consensus estimates as of May 12, 2023 (last trading day prior to transaction announcement)

- EBITDA CAGR for MMP and OKE based on financial projections as disclosed in the joint proxy statement / prospectus; peer EBITDA forecast reflects street consensus estimates as of May 12, 2023 (last trading day prior to transaction announcement)

- Based on pro forma financial projections as disclosed in the joint proxy statement / prospectus, including $415 million of synergies (the upper end of estimated risked synergies) in 2025E

- Reflects the pro forma entity's 2022A operating income plus equity earnings; reflects 2022E EBITDA breakdown for peers

- Source: ONEOK Second Quarter 2023 Earnings Presentation

Contact: | Investors: | Media: |

Paula Farrell | Bruce Heine | |

(918) 574-7650 | (918) 574-7010 | |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/magellan-midstream-files-investor-presentation-highlighting-benefits-of-pending-oneok-transaction-301913046.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/magellan-midstream-files-investor-presentation-highlighting-benefits-of-pending-oneok-transaction-301913046.html

SOURCE Magellan Midstream Partners, L.P.