ONE swiss bank SA - H1 2023 financial results

14 July 2023 – Media Release

Ad hoc announcement pursuant to Article 53 of SIX Exchange Regulation Listing Rules

ONE swiss bank SA

H1 2023 financial results (true and fair view)

H1 2023 Financial Statements can be downloaded here.

All documents are available on oneswissbank.com in the “Investor relations” section.

H1 2023 highlights

Grégoire Pennone, CEO, ONE swiss bank

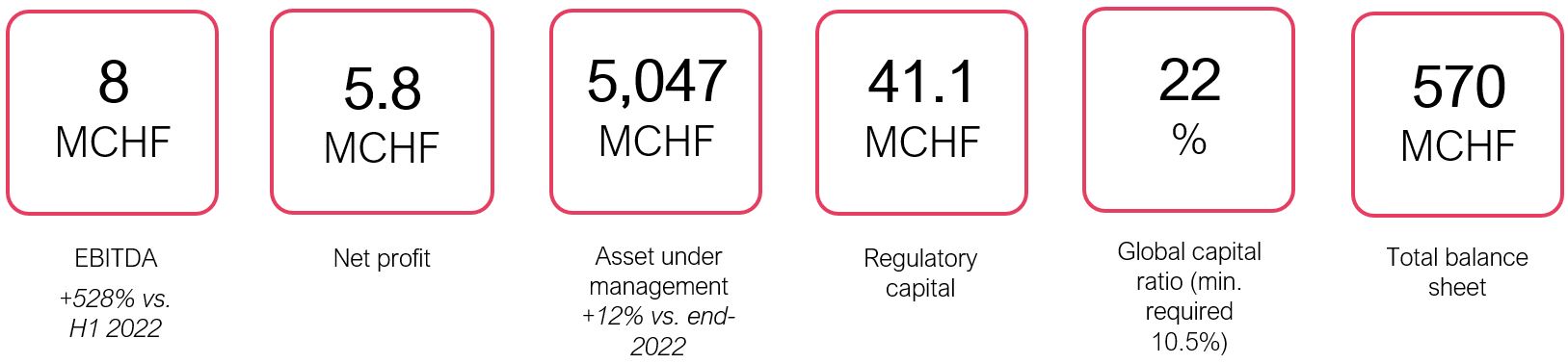

“Following the successful completion of our turnaround last year, we’re pleased to share our latest financial achievements with you today. Earnings before interest, taxes, depreciation and amortisation (EBITDA) in the first six months of the year increased by a substantial 528%, i.e. by CHF 6.73 million, demonstrating our continued focus on profitability. We’ve also seen a significant increase in net profit to CHF 5.81 million, which was CHF 6.66 million higher than in the same period last year. These positive performance indicators show that our business is well positioned to grow in the current environment.

Back in 2022, we restructured in testing macroeconomic conditions, preventing us from achieving notable organic growth. But it was also a time when we started deploying our growth strategy. During the reviewed period, assets under management rose by CHF 533 million to CHF 5.05 billion in the first half of the year, driven by CHF 456 million in net new money. Additionally, our regulatory capital was strengthened by CHF 5.3 million to stand at CHF 41.1 million, placing us on a firm footing in an ever-evolving banking landscape. Encouragingly, ONE’s share price has appreciated significantly over the last six months, both in absolute terms and relative to the Swiss banking sector.

We have weathered recent crises profitably by managing our treasury assets soundly, resulting in a highly liquid balance sheet. We are confident that our forward-looking and agile approach will enable us to capitalise on the exciting opportunities that lie ahead in the second half of 2023. Our history of acquisitions, always with a view to driving positive change, gives us the expertise and pragmatic management mindset to undertake various categories of transaction, which is quite rare for an institution of our size, while at the same time continuing to grow organically.

Besides that, sustainability remains a key focus and we need to embrace this theme faster and more broadly. We signed up to the UN Principles for Responsible Investment (PRI) in 2022 and will undertake our first reporting exercise in H2 2023. We’re looking to broaden our range of ESG products and services for institutional and private clients, having laid the foundations for our responsible investment strategy over the past six months.

Last month was a momentous occasion as we held several events to celebrate the grand opening of our new headquarters in Geneva. In addition to family and friends, we welcomed distinguished guests including local authorities, including two State Councillors, our valued clients and trusted business partners. The move is an important milestone in our development and was completed in a very short time. We now have the ideal premises in which to continue redefining the shape of tomorrow’s Swiss bank.”

H1 2023 selected financials

Key financials

Reported results (in CHF unless otherwise specified)

True-and-fair-view principle

| H1 2023 | H1 2022 | ∆ | |||

| Income statement | |||||

| Revenues | |||||

| Net result from interest operations | 10’886’729 | 3’044’468 | |||

| Result from commission business and services | 8’825’940 | 8’699’216 | |||

| Result from trading activities and the fair value option | -385’048 | 1’384’360 | |||

| Result from ordinary activities | 1’399’381 | -895’650 | |||

| Total revenues | 20’727’002 | 12’232’394 | 69% | ||

| Operating expenses | -12’718’031 | -10’957’540 | 16% | ||

| Operating result (EBITDA) | 8’008’971 | 1’274’854 | 528% | ||

| EBITDA margin | 38.6% | 10.4% | |||

| Cost/income ratio (%) | 61.4% | 89.6% | -69% | ||

| Depreciation, amortisation, extraordinary items & taxes (A) | -2’198’175 | -2’121’981 | 4% | ||

| Net profit / (loss) | 5’810’796 | -847’127 | 786% | ||

| Earnings per share | 0.38 | -0.06 | |||

(A): Including goodwill amortisation expenses resulting from the merger with One Swiss Bank SA

completed on 1 June 2021.

Net profit totalled CHF 5.81 million in H1 2023, resulting from:

- A 69% increase in revenue to CHF 20.7 million (vs. CHF 12.2 million in 2022) mainly due to higher interest rates.

- An increase in AuM mainly due to positive net inflows across all business lines (+CHF 456 million): Wealth Management +14.51%, Asset Management +4.19% and Asset Services +14.25%. Market effects were also positive in the first half 2023 (+CHF 89 million).

- A 258% increase in interest transactions in H1 2023, resulting from the positive rate environment.

- A positive trend in the cost/income ratio, which improved to 61.4% in H1 2023 (vs. 89.6% in the first half 2022).

- A strong operating profit (EBITDA) of CHF 8 million, covering depreciation and amortisation costs of CHF 2.2 million, of which CHF 1.9 million related to goodwill.

| H1 2023 | End-2022 | ∆ | ||

| Balance sheet | ||||

| Total assets | 569’805’305 | 682’232’375 | -17% | |

| Total liabilities | 522’017’098 | 637’854’023 | -18% | |

| Total equity | 47’788’207 | 44’378’352 | 8% | |

| Regulatory ratio | ||||

| CET1 ratio (%) | 21.1% | 17.7% | 19% | |

| Global capital ratio (%) | 22% | 18.5% | 19% | |

| Regulatory capital (CHF thousands) | 41’145 | 35’848 | 15% | |

| Liquidity coverage ratio (LCR) (Q average %) | 380% | 354% | 7% | |

| Clients assets (AuM) - (CHF million) | 5’047 | 4’514 | 12% | |

A balance sheet reinforced with:

- Equity of CHF 47.8 million, up 8% relative to end-2022.

- A 18% decrease in liabilities to CHF 522 million (vs. CHF 638 million at end-2022), mainly arising from reduced cash deposits as a consequence of client investing activity, including fiduciary deposits.

Increased regulatory ratios with:

- A global capital ratio of 22% (vs 18.5% as at 31 Dec. 2022), reflecting a 15% increase in regulatory capital to CHF 41.1 million as at 30 June 2023.

- A liquidity coverage ratio (LCR) of 380% versus the minimum requirement of 100%.

6-to-12 month outlook

- END -

For further information, please contact:

Julien Delécraz

Investor Relations

investorrelations@oneswiss.com

+41 58 300 78 13

ONE swiss bank SA (SIX Swiss Exchange: ONE)

ONE swiss bank is a Swiss private bank listed on the Swiss stock exchange SIX with offices in Geneva, Lugano, Zurich and a subsidiary in Dubai. It offers wealth and asset management services to private and institutional clients as well as financial intermediaries.

oneswissbank.com

Attachments